- BUDGET PLANNER CALCULATOR FREE HOW TO

- BUDGET PLANNER CALCULATOR FREE PROFESSIONAL

- BUDGET PLANNER CALCULATOR FREE FREE

For this reason, you should consider the appropriateness for the information to your own circumstances and, if necessary, seek appropriate professional advice. This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. You should obtain professional financial advice before making any financial decision. Should you apply for any BankSA product, we will make our own calculations and we will not necessarily take the results of your calculations using this Calculator into account. It is intended for use by you as a guide only, and not intended to be relied on for the purposes of making a decision in relation to a financial product. The calculator is generic and does not take into account your personal circumstances. The assumptions may not reflect the ways in which our Bank's computer systems work. This calculator model contains a number of assumptions and they are set out in the i button. Consider its appropriateness to these factors before acting on it. This information does not take your personal objectives, circumstances or needs into account. Keep checking in on your budget and make tweaks as needed or if your financial situation changes.Once you've built your savings up and have a lump sum, you could consider putting some money into a term deposit and lock your money away for a set amount of time for a guaranteed rate of return. Step 1: Enter All Sources of Monthly Income Step 2: Enter All Monthly Expenses Step 3: Enter All Monthly Savings Contributions Budget Calculator Budget Breakdown Total Monthly Income 0.00 Total Monthly Expenses 0.00 Total Monthly Savings 0.00 Under/Over Budget 0.It's worthwhile choosing a bank account that will reward you for regular saving, such as a savings account that pays a bonus interest rate for growing your balance. If your budget plan shows you've got more money coming in than going out, then you're in a good position to use some of the extra cashflow to start kicking your savings goals with a regular savings plan.If you have any ongoing car loan, personal loan and credit card repayments or if you're paying child support, include these as well. Some of your expenses are likely to be regular fortnightly or monthly expenses, such as your rent or mortgage, health insurance premiums, phone bill, gym membership and Spotify subscription. You could also look at your quarterly Business Activity Statement (BAS) and divide by 13. If you're self-employed or have an irregular income, you can work out your average weekly income by taking your last tax return and dividing it by 52 or 12 for your monthly income. If you get paid regularly, just take a look at your pay slip or bank statement. Depending on your how often you get paid, you can do a weekly, fortnightly or monthly budget.

BUDGET PLANNER CALCULATOR FREE HOW TO

See our articles How to Make a Budget and 5 Basic Budgeting Tips if you are just getting started or new to budgeting.Handy tips for creating a household budget or personal budget with our budget planner The help worksheet is much more detailed now. Percentages below the category totals show you what percent of the total family budget is going to that category. They will tell you what to do in the meantime. Your adviser will help you decide whether you need to do a budget now or wait until your finances are more stable.

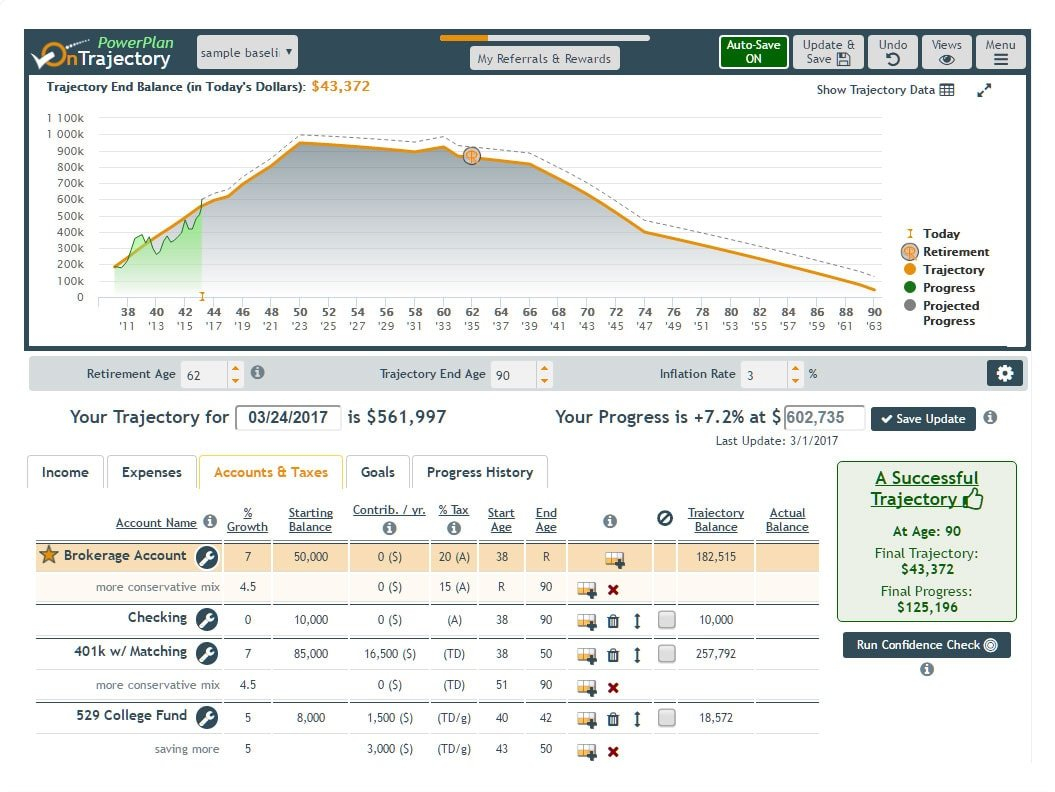

Call to speak to an adviser on 08 9am - 8pm Monday to Friday. Webchat with an adviser from 9am - 8pm Monday to Friday. New in Version 2.0: The new graphs show your spending and savings balance over time. It is still important that you get advice now. If you are moving or buying a home, you can analyze your budget to see where you may need to cut back to be able to afford an increase in rent or a higher mortgage. For example, if you are changing jobs, you can use the planner to estimate whether the increase (or decrease) in pay will still allow you to make ends meet.

BUDGET PLANNER CALCULATOR FREE FREE

This free family budget planner worksheet will help you create a yearly budget by entering amounts based on the month in which expenses are incurred.īy creating a yearly budget, you can more easily predict how major life changes will affect your finances.

0 kommentar(er)

0 kommentar(er)